NEWS AND LATEST DEVELOPMENTS

Election Results - November 3, 2020

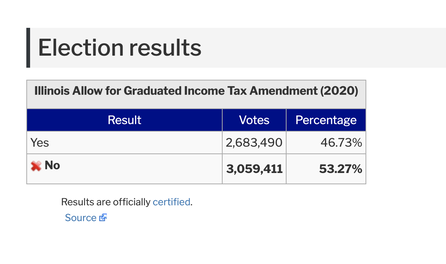

The Illinois Allow for Graduated Income Tax Amendment Ballot Measure was defeated.

The Illinois Allow for Graduated Income Tax Amendment Ballot Measure was defeated.

- A "yes" vote supported repealing the state's constitutional requirement that the state personal income tax be a flat rate and instead allow the state to enact legislation for a graduated income tax.

- A "no" vote opposed this constitutional amendment, thus continuing to require that the state personal income tax be a flat rate and prohibit a graduated income tax.

For more detailed information about the arguments for and against the Fair Tax ballot measure, visit BALLOTPEDIA.

For local election results on this vote, the Cook County Clerk's Office provides the official count by township and precinct within Suburban Cook County.

For local election results on this vote, the Cook County Clerk's Office provides the official count by township and precinct within Suburban Cook County.

Future Outlook - 2021 & Beyond

The LWVIL maintains its efforts to fund education, health care, human services and social justice initiatives while avoiding junk-bond status on mounting state debt. The League continues to work with State Legislators to identify revenue alternatives to balance the state budget. Resources shared at the 2021 LWV-IL Issues Briefing can be found here: "After the Graduated Rate Income Tax Campaign: Now What?"

The LWVIL maintains its efforts to fund education, health care, human services and social justice initiatives while avoiding junk-bond status on mounting state debt. The League continues to work with State Legislators to identify revenue alternatives to balance the state budget. Resources shared at the 2021 LWV-IL Issues Briefing can be found here: "After the Graduated Rate Income Tax Campaign: Now What?"

history of league support

At the State Level

Overall, the League believes that a progressive or graduated income tax is a more just approach to taxation, a "Fair Tax."

Overall, the League believes that a progressive or graduated income tax is a more just approach to taxation, a "Fair Tax."

- Stable & Responsive: Good tax policy allows for flexibility to design revenue structures to fit economic reality. As the income gap grows, taxing the highest wage earners at a rate proportionate to their means could more effectively access additional needed revenues.

- Equitable: The Fair Tax is based on the ability to pay. According to the Institute on Taxation and Economic Policy, the bottom 20% of wage earners in Illinois have 2X the state and local tax burden of the top 1%. The Fair Tax will help lift this disproportionate burden.

More specifically, adopting the Fair Tax in Illinois is projected to generate $3.57 billion dollars, annually, which will:

- address the structural budget deficit that exists with the current unfair IL flat tax system

- provide necessary funding to invest in priorities such as education, health care, public safety, social services and jobs

- reduce the state's backlog of unpaid bills

An amendment to the Illinois Constitution is needed to to make this change to the tax law. Passage of that referendum would mean that

97% of IL taxpayers will see either a reduction or no change in their state income taxes.

97% of IL taxpayers will see either a reduction or no change in their state income taxes.

Here in Wilmette

To support the long-standing position of LWV-IL, in partnership with the Vote Yes for Fair Tax Coalition, the LWV-Wilmette:

To support the long-standing position of LWV-IL, in partnership with the Vote Yes for Fair Tax Coalition, the LWV-Wilmette:

- advocated for a graduated rate income tax in Illinois to replace the current flat rate income tax

- educated our community about the proposed amendment to the Illinois Constitution (SJR0001) on the ballot on November 3, 2020

- According to the 2108 US Census American Community Survey, over 60% of Wilmette households will also see a reduction or no change in state income taxes.

- Our Wilmette Village Vision affirms "providing an equal opportunity to all residents to participate and share in our economic, educational, recreational, political and social activities." Supporting the "Fair Tax" Amendment can bring this vision to life for all Wilmette residents.

fair tax flyers

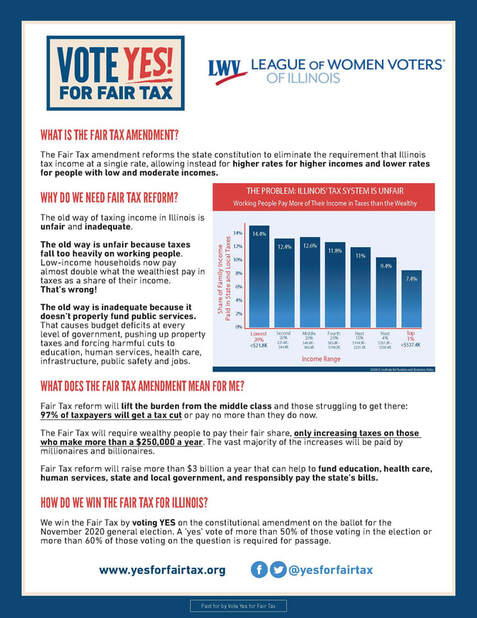

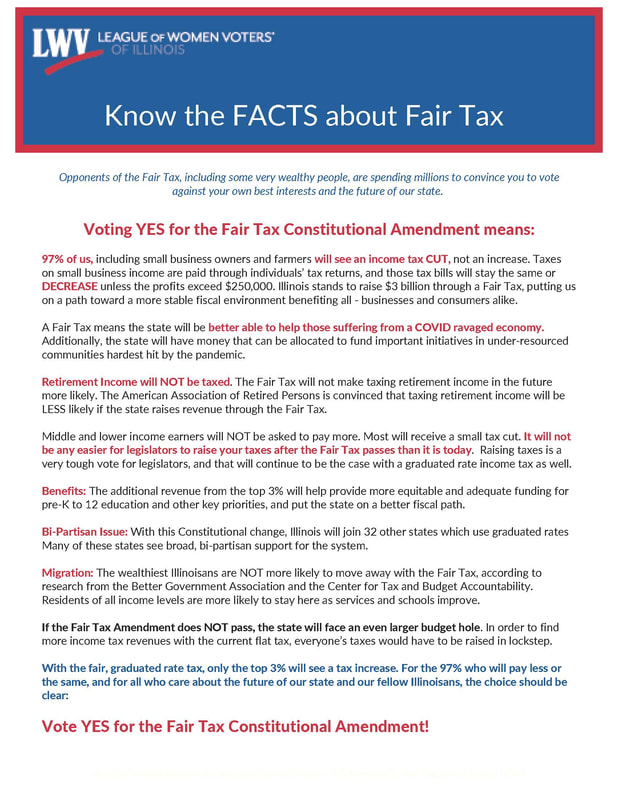

These flyers provide key facts about the Fair Tax. Share them with family, friends and organizations. Click on the images to download.

BALLOT SPECIFICS

In May 2020, the Illinois General Assembly approved the language to appear on the ballot on November 3, 2020.

resources

Vote Yes for Fair Tax Coalition Fact Sheets:

|

Video: The Fair TAx Explained in About a Minute |

LWVUS POSITION IN BRIEF

LWVUS believes that the federal tax system should:

- be fair and equitable

- provide adequate resources for government programs while allowing flexibility for financing future program changes

- be understandable to the taxpayer and encourage compliance

- accomplish its objectives without creating undue administrative problems